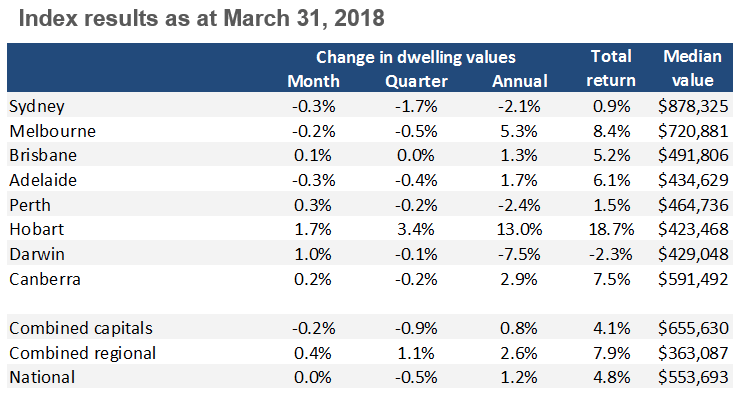

CoreLogic’s hedonic home prices index for March 2018 reveals the overarching themes of the Australian property market right now: Hobart is Australia’s strongest capital city market, the regions are outpacing growth in the capitals, and apartment prices are going up more quickly than house prices, especially in Sydney and Melbourne.

CoreLogic’s hedonic home value index shows overall Australian property prices remain unchanged in March, to be up 1.2 per cent for the year.

Hobart was the strongest growth capital city, recording a 1.7 per cent gain in March, to make an overall gain of 13.0 per cent for the year.

By comparison, Sydney prices are down 2.1 per cent for the year, and Melbourne prices are up a relatively modest 5.3 per cent.

Source: CoreLogic.

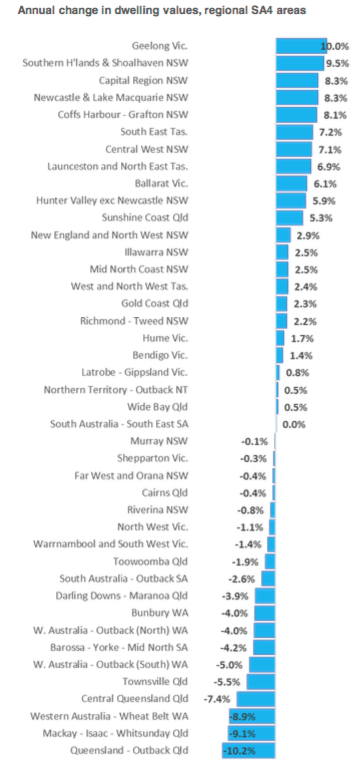

Geelong the fastest growing region

Regional markets are now consistently outperforming the combined capitals, says CoreLogic head of research Tim Lawless, in a trend that began last October.

Geelong is the fastest growing region of all, showing annual growth of 10.0 per cent.

“The market is very, very good,” Stefano Pribac, of LJ Hooker Geelong, told WILLIAMS MEDIA.

People are moving from Melbourne he said, and there are a lot of investors buying from around Australia and also from overseas. Pribac said some of the outer suburbs of Geelong, especially those close to Melbourne, are doing particularly well.

“Buyers from overseas are even buying without inspecting,” he said.

Apartments are outpacing houses in the major capitals

The unit market is outperforming the market for detached housing in Sydney and Melbourne, according to the data, a trend that became evident half-waya through last year.

For the combined capital cities, house values were down 1 per cent over the March quarter while unit values were down a more moderate 0.7 per cent.

But in Sydney unit values are up 1.9 per cent over the past twelve months, while house values are down 3.8 per cent.

In Melbourne, unit values are 6.6 per cent higher over the past twelve months while house values are up just 4.9 per cent.

“The stronger performance from the unit sector may suggest that buyer demand is becoming more concentrated in the medium to high density sector where entry prices are lower and commuting times are often more convenient when compared with the detached housing markets around the outer fringes of the city,” said Lawless.

SOURCE: The Real Estate Conversation / Core Logic